Maximize Your Business Potential with a Virtual Book Keeper

In today's fast-paced business environment, managing finances effectively is crucial for success. One of the most efficient methods to handle your accounting needs is by employing a virtual book keeper. This article will delve into the myriad benefits of using a virtual book keeper, the services they offer, and how they can help your business thrive in a competitive landscape.

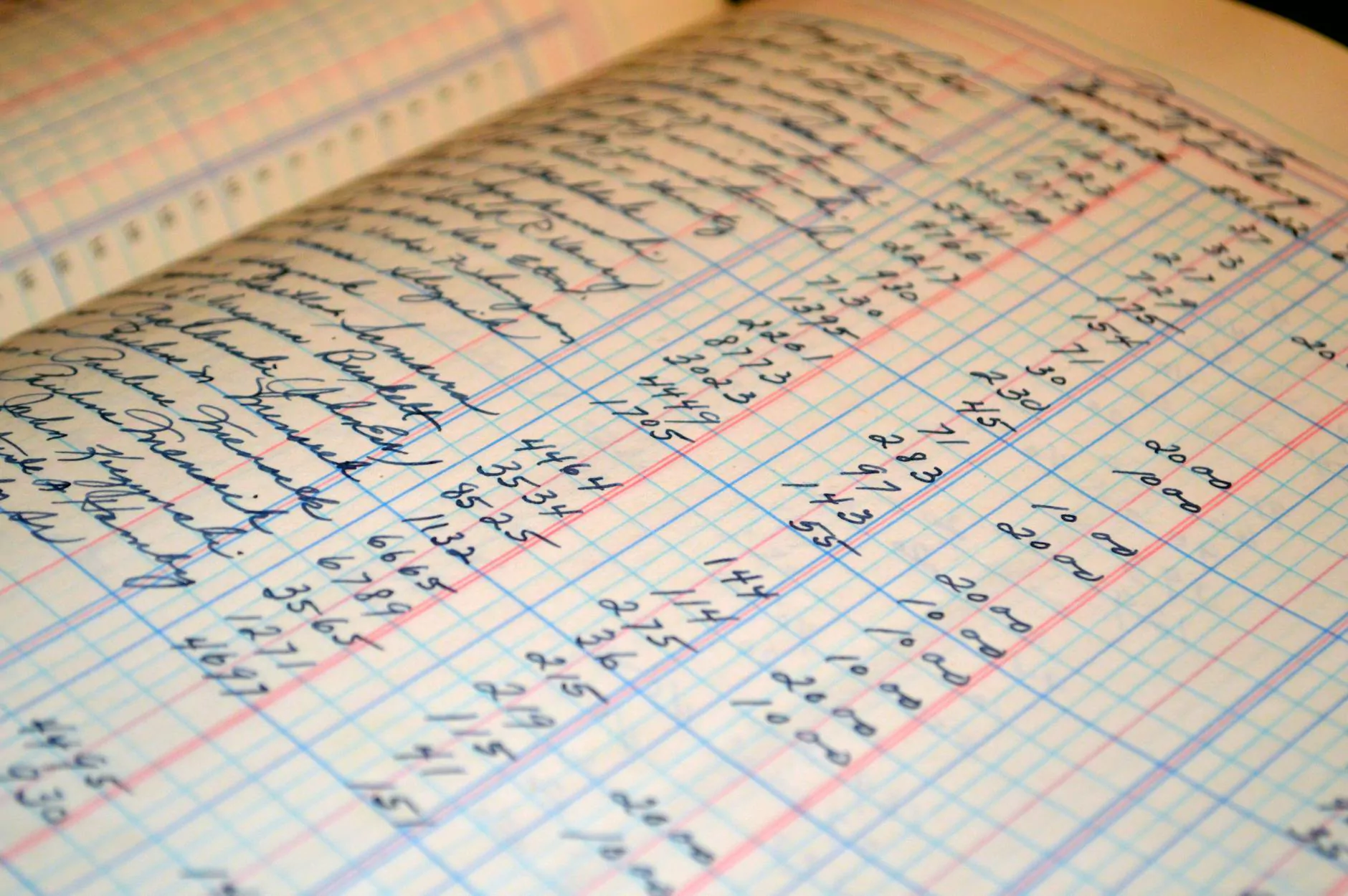

Understanding the Role of a Virtual Book Keeper

A virtual book keeper is a professional accountant who provides bookkeeping services remotely. This means that instead of hiring a traditional in-house bookkeeper who works on-site, businesses can leverage the expertise of remote professionals, saving costs and gaining flexibility.

Key Responsibilities of a Virtual Book Keeper

- Maintaining Accurate Financial Records: A virtual book keeper ensures that all financial transactions are recorded accurately, providing a clear picture of your business's financial health.

- Managing Accounts Payable and Receivable: They handle the management of invoices, bills, and payment reminders, ensuring that cash flow remains consistent.

- Reconciling Bank Statements: Virtual bookkeepers frequently reconcile bank statements to ensure that all transactions match, which helps to identify discrepancies and maintain accuracy.

- Preparing Financial Reports: They generate essential financial statements such as balance sheets, income statements, and cash flow statements, which aid in informed decision-making.

- Tax Preparation Assistance: Many virtual bookkeepers provide support during tax season, organizing documents and ensuring compliance with tax laws.

The Advantages of Hiring a Virtual Book Keeper

Utilizing a virtual book keeper offers numerous advantages that can significantly enhance your business operations. Let's explore these benefits in detail.

1. Cost-Efficiency

Hiring a full-time in-house accountant can be a significant financial burden for many businesses. Conversely, a virtual book keeper allows you to pay only for the services you need, thus reducing overhead costs. You can save on:

- Employee benefits

- Office space and equipment

- Training and development costs

This cost-efficiency is particularly beneficial for small to medium-sized businesses that require professional services without incurring excessive expenses.

2. Access to Expertise

When you hire a virtual book keeper, you gain access to professionals who possess the skills and knowledge required to manage your finances effectively. These experts stay updated on the latest accounting practices and tax laws, which can help you avoid costly mistakes and potential legal issues.

3. Enhanced Flexibility

Virtual bookkeepers typically work on a flexible schedule. This means that they can accommodate your specific needs and deadlines. Whether you require weekly financial statements or monthly summaries, a virtual book keeper can offer tailored services that fit your business rhythm.

4. Improved Time Management

Time is one of your most valuable resources. By outsourcing your bookkeeping needs to a virtual book keeper, you free up your own time to focus on core business operations such as growth strategies, customer relationship management, and product development.

5. Advanced Technology Utilization

Most virtual bookkeepers leverage modern technology and software tools to provide seamless services. This integration means that your financial data is often more organized, accessible, and secure. These technologies also facilitate real-time reporting and data analysis.

How to Choose the Right Virtual Book Keeper

Selecting the right virtual book keeper is paramount to ensure that your financial health is in capable hands. Here are some factors to consider:

1. Qualifications and Experience

Look for a virtual book keeper with relevant qualifications, such as a degree in accounting or finance, and certifications like CPA (Certified Public Accountant) or CMA (Certified Management Accountant). Experience in your specific industry can also be a significant advantage.

2. Services Offered

Different virtual bookkeepers may specialize in different services. Ensure that the professional you choose can cater to your unique needs, whether you require basic bookkeeping, tax preparation, or financial consulting services.

3. Technology Proficiency

Since a virtual book keeper uses various software and tools to manage finances, verify their proficiency in platforms relevant to your business, such as QuickBooks, Xero, or FreshBooks. A skilled virtual book keeper should be comfortable with technology and able to employ it effectively to enhance your financial management.

4. Communication Skills

Effective communication is crucial in any business relationship. The ideal virtual book keeper should be proactive in providing updates, answering questions, and ensuring that you are informed about your financial status at all times.

5. Client Reviews and Testimonials

Before making your final decision, research client reviews and testimonials. This feedback can provide valuable insights into the virtual book keeper's reliability, work quality, and professionalism.

Integrating a Virtual Book Keeper into Your Business Workflow

Once you have chosen your virtual book keeper, the next step is integrating them into your business workflow effectively. Here are some tips on how to do this:

1. Establish Clear Expectations

Begin by setting clear guidelines about your bookkeeping needs, deadlines, and communication preferences. This clarity will set the foundation for a productive working relationship.

2. Leverage Technology for Collaboration

Utilize cloud-based accounting software and tools for collaborative work. This enables your virtual book keeper to access your financial data securely and facilitate seamless communication.

3. Schedule Regular Check-Ins

Frequent check-ins can keep you informed about your financial status and allow for any immediate adjustments. These meetings provide a platform for discussing concerns and addressing any pressing issues.

4. Provide Necessary Access

Ensure that your virtual book keeper has the necessary access to your banking and financial accounts, along with any relevant documents. Grant them access to accounting software, previous financial statements, and operational processes they should be aware of.

The Future of Virtual Bookkeeping

The demand for virtual bookkeeping services is on the rise as businesses continue to adapt to remote work dynamics. The future of this industry is promising, with advancements in technology shaping how financial data is managed.

Innovations on the Horizon

As artificial intelligence and machine learning become more integrated into accounting, virtual bookkeepers will leverage these tools to automate repetitive tasks, analyze vast amounts of data, and deliver real-time financial insights. This evolution will only enhance the value they provide to businesses.

Conclusion

In conclusion, hiring a virtual book keeper presents a wealth of benefits – from cost savings to access to expertise and improved time management. By integrating a virtual bookkeeper into your business, you are not only optimizing your financial processes but also freeing up valuable resources to focus on growth and strategy.

As businesses continue to embrace remote solutions, the use of virtual bookkeeping is set to become a standard practice. To succeed in today’s competitive market, consider taking the leap into the future of finance management with a virtual bookkeeper today.